Section

Below are the latest tax insights and essential updates to keep you informed and compliant.

Landmark Decision in the Federal Court a Win for Taxpayers Regarding Division 7A

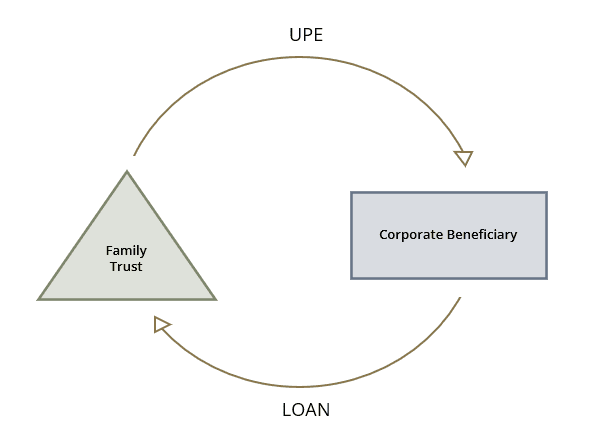

For many private groups, it is common practice to enter into arrangements in which a trust distributes income to a corporate beneficiary (i.e. a ‘bucket company’). Where the trust doesn’t pay out the distribution/entitlement to the corporate beneficiary, an unpaid present entitlement (“UPE”) arises.

Since 2010, it has been the ATO’s view (as outlined in Taxation Ruling TR 2010/3 and replaced by Taxation Determination TD 2022/11) that where a company beneficiary doesn’t call for the payment of their distribution/entitlement from the trustee, the company beneficiary is effectively providing financial accommodation to the trust which constitutes a loan for Division 7A purposes.

Division 7A of the 1936 Tax Act is an anti-avoidance measure which applies to stop shareholders (and their associates) of private companies from being able to draw funds from the company tax-free. Essentially, where a company has made a loan to a shareholder (or their associate), Division 7A will operate to treat the loan amount as an unfranked dividend in the hands of the shareholder unless the loan is:

- Repaid by the end of the financial year; or

- Put onto complying loan terms by the time the company lodges its tax return for that year.

The ATO’s approach of treating a UPE to a company beneficiary as a loan for Division 7A purposes had gone largely untested for many years – until the case of Bendel. As discussed in our October 2023 Newsletter, Bendel (the taxpayer) took on the ATO’s longstanding view in the Administrative Appeals Tribunal (“AAT”) in relation to this matter…and won. The AAT sided with the taxpayer and determined that a UPE was not a loan for Division 7A purposes.

To no one’s surprise, the Commissioner appealed the AAT’s decision to the Federal Court. On 19 February 2025, the highly anticipated decision was handed down, in which the Full Federal Court unanimously dismissed the Commissioner’s appeal, once again siding with the taxpayer. At the heart of the decision was that in substance, a loan creates an obligation for one party to repay an amount. However, in the case of a UPE, the Court’s view was that there is only an obligation for the trustee to pay, not repay, the amount of the UPE to the beneficiary. Therefore, this is not sufficient to create a loan, meaning Division 7A cannot apply.

Further, the Court stated that the ATO’s view was not consistent with the intention of Division 7A which aims to catch “in substance distributions of private company profits”.

This decision is a win for family groups with these sorts of structures and has made the ATO’s previous position untenable.

At this stage, the Commissioner has 3 options available to him:

- Appeal the decision to the High Court within 28 days;

- Request the Government to introduce amending legislation to circumvent the Court’s decision; or

- Concede and apply Division 7A as per the decision of the Full Federal Court going forward.

Before we can fully understand the practical implications of this decision, the first step is to wait and see what the Commissioner does in his 28-day appeal window. Until then, it is largely business as usual.

As such, there is still a bit to play out before we have a conclusive position going forward, although this is a historical case that is likely to change the Division 7A landscape regardless.

Finally, taxpayers should also be aware of the potential application of Subdivision EA within the Division 7A framework. Broadly, Subdivision EA applies where a trust which has a UPE owing to a corporate beneficiary, then makes a loan to a shareholder (or associate) of that private company. This may then have Division 7A implications as a deemed dividend is considered to have been paid to the shareholder (unless the shareholder repays the loan or puts the loan on a complying loan agreement).

Given the way that the ATO treated UPEs up until Bendel’s case, Subdivision EA had little practical application – although this is now likely to change.

If you want to know whether this decision may impact your Group, please reach out to your SIP advisor.

ATO Focus on Payments from Overseas

In a number of recent cases, Australian entities who have received payments from overseas family members or associates have been targeted by the ATO. Often this is through the ATO catching wind of large amounts being deposited into the taxpayer’s bank account.

The Commissioner appears to be taking a stricter approach, in that if the payment is not clearly a gift or a loan, it may be assumed that the payment is income in nature and therefore assessable. In these cases, the Commissioner may issue taxpayers with amended assessments to pay tax on these amounts, often with penalties applied.

Where the taxpayer appeals the assessment, the outcome will be largely dependent on the documentation the taxpayer can provide. A key principle of the operation of the Australian tax system is that the ‘burden of proof’ lies with the taxpayer. In other words, if a taxpayer is issued with an assessment by the Commissioner which they don’t agree with, it is the taxpayer’s responsibility to prove the Commissioner wrong. And if the taxpayer doesn’t have the relevant documentation, the burden of proof will not be satisfied.

In Rusanov v Commissioner of Taxation, the taxpayer was unable to provide adequate records which substantiated their claims that the payments were genuine gifts. Conversely, in Cheung v Commissioner of Taxation, the evidence provided by the taxpayer was sufficient to convince the court that the payment was not income and was indeed a gift.

The ATO has provided guidance on the types of evidence that may be required when documenting gifts and loans from overseas entities.

In the case of gifts, some examples include:

- A declaration the donor has made in their country of residence about the nature of the amounts transferred

- An executed contemporaneous deed of gift prepared by the donor

- A certified copy of the donor’s will or distribution statement for the estate (if received as an inheritance)

- Financial records reflecting the donor’s transfer to you

In the case of loans, some examples include:

- A properly documented loan agreement

- Correspondence relating to the loan, including pre-contractual negotiations as to the terms

- Documents about any security provided or guarantees given in support of the loan

- Financial records such as bank statements showing the advance of funds and subsequent repayments, including interest and principal payments over the loan term

- Any declarations the lender has made in their country of residence about the provision of the loan

- Financial plans, cashflow forecasts, net assets position or budgets showing an intention or capacity to repay the loan.

If you are planning to receive, or have already received, a gift or a loan from an overseas related party, we encourage you to reach out to your SIP advisor. It is imperative that you have adequate documentation in place which can substantiate the nature of the payment.

Albanese Government Clamping Down on Foreign Purchase of Established Homes and Land Banking

The Albanese Government has announced a two-year ban on foreign investors (including temporary residents and foreign companies) purchasing established homes in Australia, effective from 1 April 2025. This temporary measure aims to ease pressure on the housing market, allowing Australians greater access to homes. Essentially, the ban should mean Australians should be able to buy homes that may have otherwise been bought by foreign investors.

The ban will last until March 2027, with a review to assess its extension after this. Exceptions will apply for investments that significantly boost housing supply.

In addition to the ban, the government is cracking down on land banking by foreign investors — hoarding land without developing it — by allocating $8.9 million over 4 years to strengthen compliance and enforcement of existing development conditions that foreign investors are subject to. The ATO will increase its efforts to ensure foreign investors meet development deadlines and requirements, targeting land banking practices that ultimately delay essential housing and commercial projects.

Foreign investors that have already acquired or are proposing to acquire vacant residential or non-residential land will be subject to heightened scrutiny by the ATO and Treasury.

Further guidance on these measures will be released prior to their commencement.

Proposal for Small Business $20K Deduction for Entertainment

Generally, expenses that are characterised as ‘entertainment’ are not eligible for a tax deduction. However, opposition leader Peter Dutton announced in January that if the Coalition is elected, they propose to allow small businesses to claim a deduction for meal and entertainment expenses. While there is little guidance so far on how the policy would operate, the key details are:

- A deduction for business-related meal and entertainment expenses would be allowable, capped at a maximum deduction of $20,000 (based on a 25% company tax rate, this would result in a tax benefit of $5,000).

- Small businesses with turnover below $10 million would be eligible.

- The relevant meal and entertainment expenditure relating to employees would be exempt from FBT.

- Alcohol is excluded from the proposal.

While the measure would benefit small businesses, it would also come with a range of complexities relating to its implementation. For instance, how the expenditure would be treated from a GST perspective (i.e. whether GST credits can be claimed on the deductible entertainment) and how it would interact with the FBT provisions remains to be seen.

The interaction between income tax, GST and FBT is already a complex area. While this proposal sounds good on paper, we will need to await further clarification on how it would operate practically.

FBT Time Just Around the Corner

As the end of the 2025 FBT year approaches, we’ve listed some key FBT items for your consideration before 31 March 2025:

- Motor vehicle records, such as logbooks, odometer readings and records of employee contributions towards motor vehicle expenses.

- Employee declarations of business/private usage for mobile phone and motor vehicles (including workhorse vehicle declarations).

- Accurate details of entertainment expenditure if using the ‘actual method’, e.g. headcounts of employees/clients at events.

- Records relating to any carparking provided to staff.

- Details of new vehicles purchased during the year.

Although you may not have lodged FBT returns previously, you should always consider any benefits provided to staff and whether you may have triggered a requirement to register for FBT during the current FBT year (1 April 2024 – 31 March 2025). For instance, you may have acquired a new company vehicle this year that is available for private usage, or you may have provided car parking to staff.

Conversely, if you are registered for FBT but have not provided any benefits during the current FBT year, we still recommend you lodge a nil FBT return.

Additionally, the FBT exemption for electric vehicles is still available, although this is the last year that plug-in hybrid electric vehicles (“PHEV”) will be included. PHEVs purchased after 1 April 2025 will no longer qualify for the exemption.

Where there is a financially binding commitment (e.g. a novated lease) to provide private use of a PHEV that was entered into before 1 April 2025, it should continue to be exempt assuming it met the exemption criteria before that date and as long as the agreement remains unchanged.

FBT returns are due on 25 June 2025 if prepared and lodged by us as your tax agent. Otherwise, they are due on 21 May if you prepare your own FBT return.

* * * * * * * *

The above tax summary is intended to be general in nature and does not constitute advice. Should you believe that any of the above matters may be relevant to you or your Group’s particular circumstances, please discuss the specific details with your Slomoi Immerman Partners advisor.