Jump to Section

Full Federal Court Decision on Trust Distributions & Reimbursement Agreements – Application of Section 100A and Part IVA

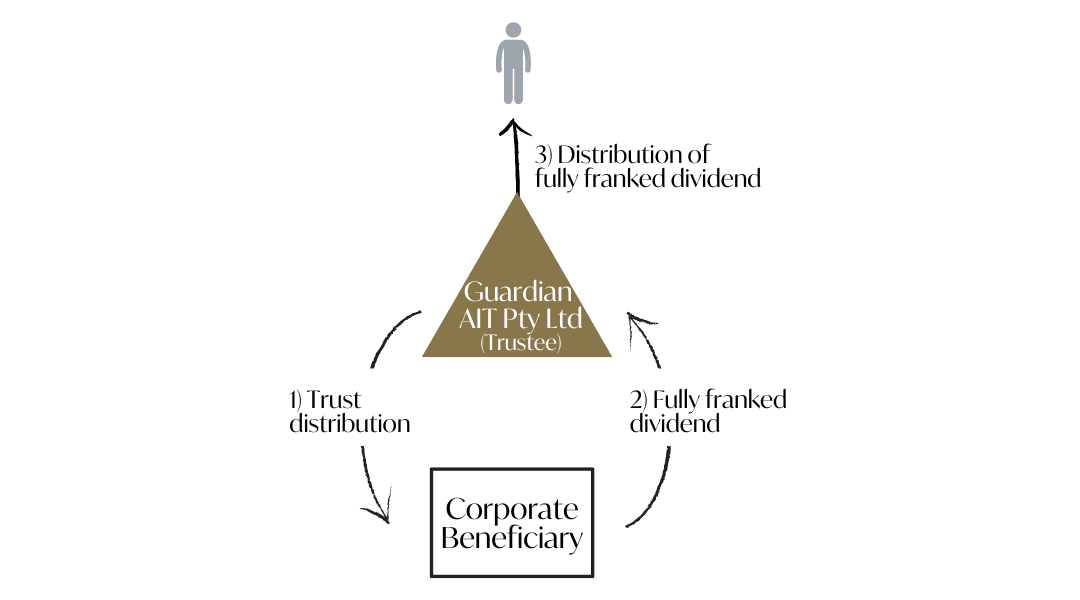

The Guardian case examined an arrangement where the Trustee (Guardian AIT Pty Ltd) made a corporate beneficiary presently entitled to trust income. The corporate beneficiary called on a portion of the unpaid present entitlement (UPE) to pay their tax liability, and then was able to offset the remainder of the UPE by paying the trust a franked dividend. The dividend income was then distributed to a non-resident individual beneficiary (who controlled the Group) who was able to take advantage of non-residents receiving franked dividend tax-free, ie. no withholding tax payable. Had the Trustee distributed the income directly to the non-resident beneficiary, more tax would have been payable as compared to the distribution chain adopted.

In our December Tax Newsletter, we discussed the Australian Tax Office’s (ATO) updated guidance on s100A, which governs trust distribution arrangements where broadly, there is a ‘reimbursement agreement’ in place resulting in the benefit of a trust entitlement being received by a person or entity other than the beneficiary who was actually entitled to the trust income. The primary exception is where the arrangement was entered into in the course of ordinary family or commercial dealings.

In our December Tax Newsletter, we discussed the Australian Tax Office’s (ATO) updated guidance on s100A, which governs trust distribution arrangements where broadly, there is a ‘reimbursement agreement’ in place resulting in the benefit of a trust entitlement being received by a person or entity other than the beneficiary who was actually entitled to the trust income. The primary exception is where the arrangement was entered into in the course of ordinary family or commercial dealings.

The Full Federal Court concluded there was no specific plan between the parties when the distribution was resolved that the beneficiary would pay a dividend back to the trust. Therefore, there could not have been a ‘reimbursement agreement’ in place, meaning s100A did not apply.

The decision provides useful context as to what types of agreements may constitute a ‘reimbursement agreement’. However, in this case the Full Federal Court did not feel it was relevant to address the concept of ‘ordinary family or commercial dealings’, an issue which remains quite unclear and of particular importance to family groups.

After the recent release of the ATO’s updated guidance on s100A, we were hoping that the Guardian case would provide some further insight on how the Courts may apply the ordinary family or commercial dealings exception. However, we may have to wait a bit longer to get such clarity.

While the Full Federal Court dismissed the Commissioner’s appeal in respect of s100A, it supported the application of Part IVA of the 1936 Tax Act to reduce the beneficiary’s tax benefit. Part IVA is a general anti-avoidance provision designed to capture arrangements where a scheme has been entered into for the dominant purpose of obtaining a tax benefit.

Furthermore, it highlights that even though arrangements may be safe from s100A, there may still be unexpected tax outcomes if the Commissioner determines that Part IVA applies.

New Queensland Payroll Tax Ruling Impacts Medical Centres: What Healthcare Providers Need to Know

On 22 December 2022, the Queensland Revenue Office (“QRO”) released Payroll Tax ruling PTAQ000.6.1 – “Relevant Contracts – Medical Centres” to clarify how the Payroll Tax contractor provisions will be applied to agreements between medical centres and healthcare providers, including doctors, dental practitioners, physiotherapists, radiologists, and others. This ruling is a response to recent tribunal and court cases in Victoria and New South Wales, such as the Optical Superstore and Thomas and Naaz cases, which have focused on Payroll Tax implications for medical centres and practitioners.

Although the ruling is set to take effect from its release date, it is hoped that the QRO will limit its audit activities to the 2022 financial year and beyond and not conduct any audit activity for prior years. Although this is a QRO ruling, it is likely that the Victorian and NSW State Revenue Offices will adopt a similar approach.

The key takeaways from the ruling include the following:

- Given the broad approach, Payroll Tax is likely to be payable on payments from a medical centre to a practitioner under a service or facilities agreement, as these are considered contractor payments. Serving patients for, or on behalf of, the medical centre is all that’s required for the arrangement to constitute the practitioner supplying work-related services to a medical centre.

- This would apply even if the agreement is written such that the medical centre provides services to the practitioner, to the extent that the medical centre holds out to the public that it provides access to medical services and has operational or administrative control over the practitioners.

- Payments to a practitioner, even if made from money received by the medical centre on behalf of the practitioner, will still be subject to Payroll Tax.

- However, some payments may fall within the contractor exemptions. The three exemptions most likely to apply may be where:

- the practitioner provides services to the public generally;

- the practitioner works for no more than 90 days in a financial year; or

- the services are performed by two or more persons.

- If patient fees or Medicare payments are paid to a third party that then pays a portion to the medical centre and a portion to the practitioner, the amount paid to the practitioner may still be considered taxable wages paid by the medical centre.

Example (extract from Example 1 of the Ruling):

Consider the case of ABC Pty Ltd, which operates a medical centre that provides patients with access to medical services performed by practitioners who are engaged by ABC Pty Ltd.

Practitioners are engaged by ABC to provide their services to the medical centre by serving patients of the centre, and contracts between ABC and the practitioners require ABC to provide consultation rooms, manage appointments, maintain patient information and medical records, collect fees, and pay practitioners a share of revenue.

According to the ruling, each contract between ABC and a practitioner satisfies the requirement to supply services “in relation to the performance of work”.

This would therefore be an arrangement in which the payments made to the practitioner are captured for Payroll Tax purposes.

It’s important to note that the Thomas and Naaz case, in which this ruling is a response to, is still under appeal, and if the court reaches a different decision, the public ruling may need to be revised accordingly.

Medical and healthcare centres across Australia with service facility arrangements should be aware of the potential exposure to Payroll Tax arising from payments made under these agreements. It is recommended that all current service agreements be reviewed to assess the Payroll Tax risk and determine if any exemptions apply.

WFH Deductions – Final guidelines have been released.

Following on from our December newsletter where we discussed the significant changes in the way we can claim Work From Home deductions, the ATO have just finalised their guidance – PCG 2023/1 – Claiming a deduction for additional running expenses incurred while working from home.

The revised fixed-rate method for calculating the deduction an individual can claim for expenses incurred whilst working from home will replace the previous fixed-rate method and the temporary Covid shortcut of 80c per hour. The new revised method will have a rate of 67c per hour.

The key point to take from the finalised guidelines are the cumbersome record keeping requirements:

- From 1 March 2023 a record of each hour you work from home will be required to be maintained, rather than simply estimating the number of hours worked when the time comes to preparing your tax returns.

- For the period 1 July 2022 to 28 February 2023, a record which is representative of the total number of hours worked from home will be acceptable.

Please see our December newsletter for a detailed example of how the new method will operate in practice.

ATO Releases Updated Guidance on Employee vs Contractor Distinction in Response to Recent High Court Decisions

The distinction between employees and contractors is a crucial aspect of employment law. It also has significant tax implications for both employers and workers, as employees and contractors are taxed differently.

Following the recent High Court decisions in CFMEU & Anor v Personnel Contracting Pty Ltd and ZG Operations Australia Pty Ltd & Anor v Jamsek & Ors, the Australian Taxation Office (“ATO”) has released updated guidance to help employers understand the distinction between employees and contractors and ensure compliance with their Pay As You Go Withholding (“PAYGW”) and Superannuation Guarantee (“SG”) obligations.

Applying the wrong classification can lead to significant penalties for a business, particularly where it operated under the assumption that Superannuation was not required to be paid in respect of the worker. With changes to the way in which work is performed these days (eg. gig economy), establishing whether a worker is an employee or contractor has become more complex.

Draft Taxation Ruling TR 2022/D3

In line with the recent High Court decisions, the ATO has released TR 2022/D3 which emphasises the importance of considering contractual rights and obligations in determining the employment status of a worker,. The focus of the Draft Ruling is whether the worker is working in the entity’s business, which is determined by examining the overall relationship between the parties, as indicated by the terms of the contract.

The Draft Ruling clarifies that the characterisation of the worker cannot be solely based on the written contract and that a simple checklist cannot be the basis of assessment. Although the Draft Ruling acknowledges that the nature of the relationship is determined by the legal rights and obligations specified in the contract, it expands on instances where the contract can be disregarded, such as by variation, waiver, or sham arrangements.

TR 2022/D3 states that the previous “totality of the relationship” approach that considers various factors remains relevant, but only to assess the contractual rights and obligations of the parties. The following factors, however, will still be helpful in determining whether the worker is working in the business of the engaging entity (making them an employee) or whether the worker is providing services to a principal’s business whilst furthering their own business enterprise (making them an independent contractor):

- Control: An employee is usually subject to the employer’s control, while a contractor is generally free to determine the way in which they perform their work.

- Results: Results-based contracts and compensation that is often based on a fixed sum rather than hours worked, are strong indicators of an independent contractor relationship.

- Tools and Equipment: An employee is usually provided with the necessary equipment and tools by the employer, while a contractor is usually responsible for providing their own tools and equipment.

- Risk: An employee typically has limited financial risk, while a contractor usually bears the risk of making a profit or loss. However, the Draft Ruling states that a contractual clause requiring insurance coverage will not hold weight if other factors support an employment conclusion.

Practical Compliance Guidelines PCG 2022/D5

PCG 2022/D5 outlines the Commissioner’s risk framework for worker classification arrangements, which includes a self-assessment tool to help parties understand the chances of the ATO conducting a compliance review of their arrangement.

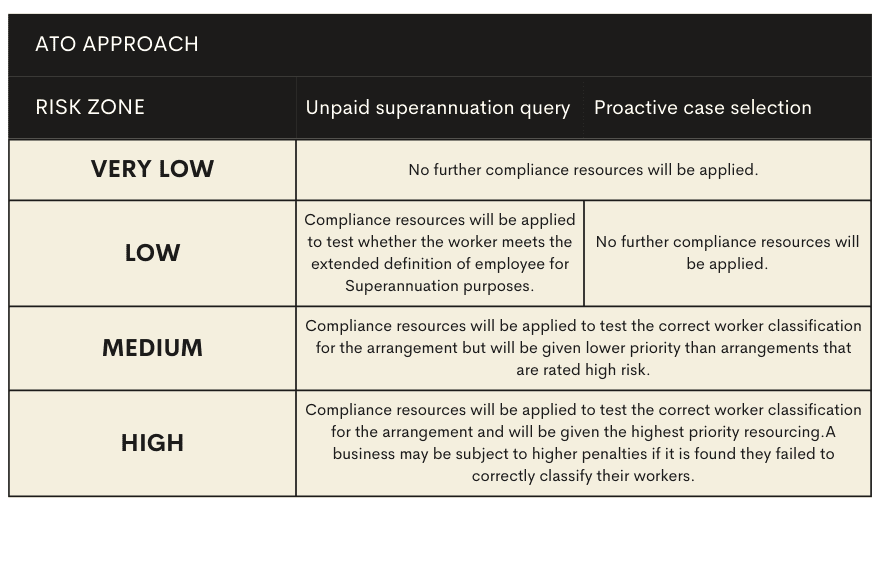

The framework (see table below) outlines four ‘risk zones’ and clarifies the difference between being selected by the ATO for a review and a review initiated by an employee or contractor complaint where there is a query of unpaid Superannuation.

The draft PCG contains various scenarios to illustrate how the ATO will assess the level of risk related to worker classifications based on the actions taken by the parties when entering into the arrangement. Examples of these indicators may include:

- Very Low and Low risk categories – reflect situations where both parties (ie. the business and the worker) agreed on the work classification and the entity received advice confirming that their classification was correct under both the common law definition of employee and the extended tax definition.

- Medium risk category – arise where the arrangement has deviated significantly from the contractual rights and obligations initially agreed to by the parties and the entity is not meeting the correct tax, superannuation and reporting obligations that arise for that classification.

- High risk category – arise where the entities did not turn any attention to the manner in which the worker in the arrangement was classified. Also, the parties may not have agreed on a classification and one party may have even coerced or deceived the other to accept the arrangement as being a particular classification.

Additionally, the draft guidance notes that where a party has self-assessed a risk category when an arrangement was entered into, the risk rating will need reassessment should any circumstances materially change.

It is important to note that the draft PCG does not extend to the following matters:

- Income tax affairs of the worker, ie. whether they have the ability to claim deductions or concessions associated with carrying on a business or whether the Personal Services Income rules apply to their arrangement;

- Employment law issues under the Fair Work Act 2009;

- State revenue issues such as Payroll Tax;

- Worker insurance related matters; and

- Obligations under a contractor or applicable award or enterprise agreement (including where the obligations relate to the payment of Superannuation).

Both TR 2022/D3 and PCG 2022/D5 are currently in draft, pending any comments received. The ATO’s previous ruling on employees (TR 2005/16) has now been withdrawn.

Are You Still Using Your ABN?

The Australian Taxation Office (“ATO”) may deem your Australian Business Number (“ABN”) as inactive if you haven’t reported any business activity in your tax return, or if there are no signs of business activity in other lodgements or third-party information that the ATO receives.

In this case, the ATO may contact you to advise that your ABN will be cancelled if no action is taken. They will also outline what you need to do if you still require your ABN.

In the event that your ABN is cancelled but you are still entitled to it, you can reapply for the same ABN as long as you are operating under the same business structure. However, if your business structure has changed (eg. you were operating as a sole trader but changed to a company), you will need to apply for a new ABN.

The Government’s ABN cancellation program is aimed at ensuring that ABR data is up to date, as this information is used by emergency services and government agencies, for example to identify where financial disaster relief is needed during natural disasters. Therefore, the onus falls on the ABN holder to keep their business details up to date on the ABR.

If you are continuing to use an ABN for business activities, ensure that this is reflected in your tax returns and that your lodgements to the ATO are made on time to avoid the risk of your ABN being cancelled. Additionally, we recommend updating your details on the ABR whenever they change.

If you receive correspondence from the ATO about cancellation of your ABN, please reach out to our team if you require assistance.

* * * * * * * *

The above tax summary is intended to be general in nature. Should you believe that any of the above matters may be relevant to you or your Group’s particular circumstances, please discuss the specific details with your Slomoi Immerman Partners advisor.