Section

Below are the latest tax insights and essential updates to keep you informed and compliant.

No Deduction for GIC and SIC

Currently, taxpayers may claim income tax deductions for the General Interest Charge (“GIC”) and Shortfall Interest Charge (“SIC”) in the year in which the charges are incurred. GIC is imposed for the late payment of a tax liability, while SIC is applied when there is a shortfall in tax paid.

However, as part of the 2023–24 Mid-Year Economic and Fiscal Outlook (“MYEFO”), the government announced that they would deny deductions for GIC and SIC. Draft legislation has been released on this, which is intended to apply from 1 July 2025.

This is likely to be a further blow for businesses already struggling to meet their tax obligations and feeling the pressure of high interest rates, with a disproportionate impact on sole traders on the highest marginal tax rate. Effectively, the non-deductibility of GIC and SIC increases the penalty rate by 25% for small companies, and up to 47% for sole traders (depending on their marginal tax rate).

Although the ATO has advised that taxpayers can still apply for a remission of GIC and SIC, this comes as the ATO has significantly tightened their stance on remissions of interest charges. In recent months, we’ve seen a clear change in the ATO’s approach, with more and more interest remission requests being rejected on grounds that would have previously been considered fair and reasonable.

Although this has not yet been legislated, we would expect this measure to pass through parliament. It would be prudent to consider your financing options in the event your business is facing cash-flow difficulties as debt deductions continue to be deductible subject to the usual limitations. In other words, Taxpayers using the ATO as a short-term financier by deferring the payment of tax debts may need to consider using traditional bank funding to pay their tax debts where there is not sufficient cash flow in the business.

Reporting Requirements Clarified for Vacant Residential Land Tax – Including for Holiday Homes

Broadly, from 1 January 2025, residential properties in Victoria (excluding your main residence) which are left vacant for more than 6 months of the preceding calendar year may be subject to Vacant Residential Land Tax (“VRLT”) at a rate of 1% of the property’s capital improved value (“CIV”) (increasing to 2% of the CIV in the second year of vacancy, and up to 3% from the third year of vacancy).

Various exemptions apply, such as if the property is occupied as your holiday home for at least 4 weeks of the year. As mentioned in 2024 EOFY newsletter in June, the Victorian government confirmed that the holiday home exemption will apply to holiday homes held in a trust or company, subject to certain conditions being met, such as:

- The land must have been held in the company or trust (or contract of purchase entered into) on or before 28 November 2023.

- Currently, the legislation is written such that the property must be used and occupied as a holiday home for at least 4 weeks by an individual shareholder of at least 50% (in the case of a company) or a specified individual beneficiary (in the case of a discretionary trust), or their relative.

- However, a new proposal has recently been introduced to Victorian parliament which would expand the scope of the holiday home exemption to companies or unit trusts held by discretionary trusts, or chains of companies. For example, if a company that owns a holiday home is owned by a discretionary trust, it may still be eligible to apply to the holiday home exemption if the property is used by a specified beneficiary of the trust.

- This amendment has not yet been passed and is still subject to approval by parliament.

Please refer to our 2024 EOFY newsletter for additional requirements for the holiday home exemption.

As per the SRO’s reporting requirements, owners of vacant residential property are required to notify the SRO by 15 January each year via the online portal on the SRO website to ensure that VRLT is applied correctly.

If a property is eligible for an exemption, such as the holiday home exemption, the SRO’s instructions advise that the land owner is still required to notify the SRO and apply for the exemption via the same portal. This requirement appears to be merely for information gathering purposes as no VRLT should apply if you are eligible for the holiday home exemption.

Should you require assistance with VRLT reporting, please reach out to your SiP advisor.

Updated ATO Guidance on 99B

Section 99B of the 1936 Tax Act (“99B”) ensures certain benefits received by Australian resident beneficiaries from a foreign trust are subject to tax in Australia. The ATO has recently clarified their views on the application of 99B through the release of draft guidance TD 2024/D2 and PCG 2024/D1

Where a non-resident trust estate provides a benefit to a beneficiary that is an Australian tax resident at any point during the financial year, 99B may apply to tax the beneficiary on the benefit, subject to certain exceptions.

Assessable benefits under 99B include more than just payments/distributions. The Commissioner suggests that 99B should be considered in the following common scenarios:

- A non-resident migrating to Australia who later receives a distribution from a non-resident trust;

- An Australian resident beneficiary receiving a distribution, gift or loan from a non-resident trust;

- The trustee allowing a resident beneficiary to use non-resident trust property;

- An Australian resident beneficiary receiving an amount from a non-resident deceased estate; or

- An Australian resident beneficiary receiving a loan from a non-resident trust that is later forgiven.

Broadly, the 2 key exceptions which may prevent 99B from applying are:

- The ‘corpus exception’ – an amount that represents corpus of the foreign trust is excluded. Corpus is typically amounts that are settled or gifted to the trust when the trust is established.

- The ‘non-taxable exception’ – an amount that, if it had been derived by an Australian resident taxpayer, would not have been included in the assessable income of that Australian resident taxpayer.

As can be seen, both of these exceptions rely on the assessment of whether the benefit is sourced from amounts that would have been taxable to an Australian resident taxpayer (i.e. the ‘hypothetical taxpayer’). For instance, a distribution of proceeds from the sale of an asset acquired pre-CGT would not be taxable to the hypothetical taxpayer, thus escaping 99B.

Therefore, it is critical to have documentation verifying the source of benefits received from foreign trusts. If the ATO applies a 99B assessment, the onus is on the taxpayer to prove that one of the exceptions applies. Practically, it may be difficult to obtain the required documentation in relation to the foreign trust. In the PCG, the Commissioner includes examples that may be considered high risk and low risk.

Section 99B appears to be on the ATO’s radar, evidenced by the release of this new draft guidance. If you’ve received distributions from a foreign trust and in particular if you have recently migrated, please reach out to your SiP advisor to discuss whether 99B may apply.

Additional Levy on Short Stay Rentals

As announced by the Victorian government in 2023, a short stay accommodation levy (“SSAL”) is being introduced in an attempt to ease pressure on the Victorian rental market. The legislation has been passed (received royal assent on 29 October 2024) and introduces a 7.5% levy on short stay accommodation bookings from 1 January 2025.

Key features of this measure are:

- A short stay is considered as a booking of less than 28 days.

- The levy will be a flat 7.5% of total booking fees paid, including fees and charges such as cleaning fees and GST (where applicable).

- For a booking made through a booking platform (whether online, such as Airbnb or Stayz, or through a rental agent), the booking platform pays the levy on the total fees for that booking. For a booking made directly with the owner or renter of a property, the owner/renter pays the levy on the total fees for that booking.

- The levy does not apply to a property that is someone’s principal place of residence, whether they own or rent that property. For example, if you go on holidays for 2 weeks, and during that period you use your home as short stay accommodation, the SSAL will not apply to bookings during that period.

- Certain types of accommodation are exempt from the SSAL, such as commercial residential accommodation (hotels, hostels etc), retirement villages and student accommodation provided in connection with an educational institution.

- If your total annual booking fees are $75,000 or less, you will complete an annual return. If your total annual booking fees are more than $75,000, you will need to lodge quarterly returns. The quarterly periods begin on 1 January, 1 April, 1 July and 1 October each year. This means you must lodge your first return and pay the levy by 30 April 2025.

- If you are liable to pay the levy, you must register with the SRO by the due date of your first return.

- The levy will not apply to bookings made before 1 January 2025, even if the stay is completed on or after 1 January 2025.

The implications are that the SSAL will likely be passed onto the customer, meaning that from 1 January 2025 we can expect to see prices of short-stay rentals increasing by 7.5%.

Draft ATO Guidance on the Interaction Between Part IVA and the PSI Rules

The ATO has issued draft guidance (PCG 2024/D2) on the potential application of the general anti-avoidance provisions in Part IVA of the 1936 Tax Act to taxpayers who earn Personal Services Income (“PSI”). This is relevant for individuals who earn PSI but are not subject to the PSI rules due to operating a Personal Services Business.

If you earn income under a contract which relates to your personal efforts or skill, rather than for the sale of goods or use of business assets, you may be earning PSI. You can receive PSI in many different industries or professions, but some common examples include financial advisors, consultants and medical practitioners.

If you receive PSI, the PSI rules apply unless you are operating a Personal Services Business (“PSB”). Broadly, you will be operating a PSB if:

- Any one of the following 4 tests are passed:

- ‘Results test’ – At least 75% of your PSI is for producing a result for which you supply the tools of trade and are responsible for fixing any defects;

- ‘Unrelated clients test’ – You have at least 2 unrelated clients and your services have been solicited from the public;

- ‘Employment test’ – At least 20% of the principal work is performed by an employee/contractor or you have employed an apprentice for at least 6 months; or

- ‘Business premises test’ – You have a business premises.

If relying on the unrelated clients test, the employment test or the business premises test, you must earn less than 80% of your PSI from one client.

The PSI rules operate to ensure that income earned as a result of personal efforts and skill are attributed to the individual by preventing the alienation of income to another person or entity. Therefore, the rules effectively look through the entity used to carry out the business and attribute the income to the individual. A key characteristic of schemes to alienate PSI is the lowering of the effective income tax on that income.

The ATO’s draft Practical Compliance Guideline (“PCG”) PCG 2024/D2 outlines the Commissioner’s view that even where the PSI rules don’t apply due to the presence of a PSB, alienation arrangements may still be caught by the general anti-avoidance rules (Part IVA).

In the PCG, the Commissioner considers examples of arrangements that are at risk of Part IVA applying. Examples from the PCG of high-risk indicators include:

- The net PSI is distributed to another entity so that it is taxed at an overall lower rate than if the individual had received the income directly.

- The remuneration received by the individual is less than commensurate with the value of their personal services.

- Remuneration is paid to an associate (or a service trust) that is not commensurate with the skills exercised or services provided by the associate.

The following is an example of a PSI alienation arrangement that may attract ATO attention:

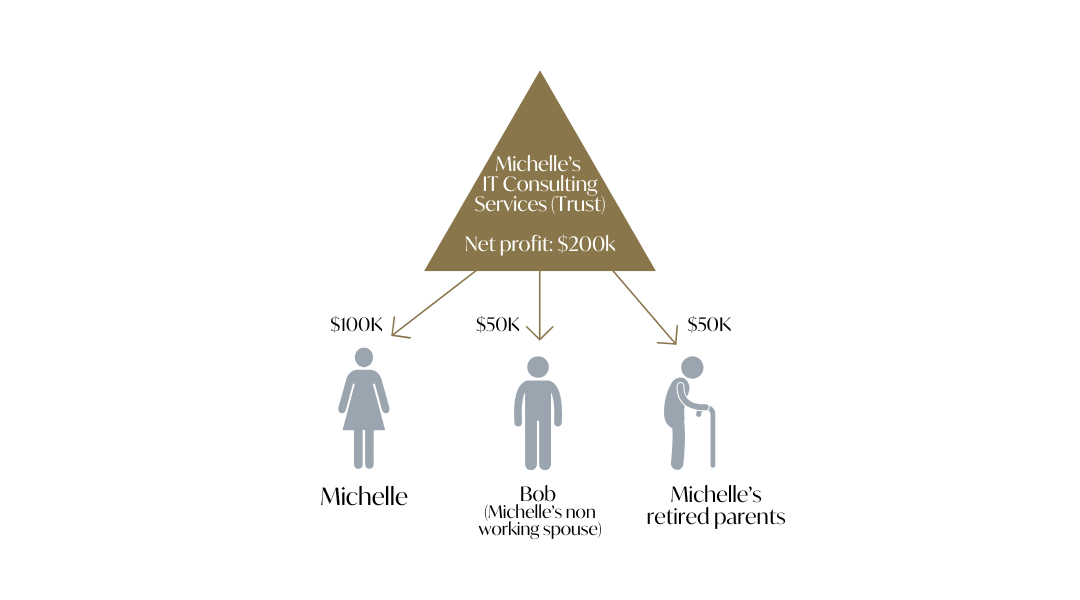

Michelle operates an IT consulting business out of a trust. The income generated in the trust would constitute PSI. To the extent that the business passes one of the relevant tests (for example, passing the unrelated clients test by earning income from multiple clients with less than 80% of the trust’s income coming from any single client), the trust will be considered a PSB and therefore the PSI rules should not apply. However, as Michelle has distributed PSI to her spouse and parents such that the net income is taxed at an overall lower rate than if Michelle had received the $200k directly, this alienation arrangement may be subject to ATO scrutiny under Part IVA.

This draft guidance follows a string of recent Part IVA cases, further highlighting the ATO’s current focus on Part IVA. It is important to note that while the PCG has outlined the Commissioner’s views, it is not the law and it remains the Commissioner’s views only.

Should you wish to discuss the application of the PSI rules or Part IVA to your circumstances, please reach out to your SiP advisor.

* * * * * * * *

The above tax summary is intended to be general in nature and does not constitute advice. Should you believe that any of the above matters may be relevant to you or your Group’s particular circumstances, please discuss the specific details with your Slomoi Immerman Partners advisor.